People move from all over the world in order to make buying a home in Seattle a reality. It’s no wonder.

In addition to being one of the nation’s fastest growing tech hubs, Seattle has a natural beauty and plethora of outdoor activities. Seattle also boasts a diverse music scene, and artistic culture. Seattle is also a great place to live if you’re a coffee enthusiast, foodie, dog lover, or literature nerd.

Essentially, there’s something for just about everyone in the Emerald City. You just have to find the right house to settle down in.

That’s where this guide comes in, covering everything you need to know about buying a home in Seattle.

Seattle Real Estate Trends

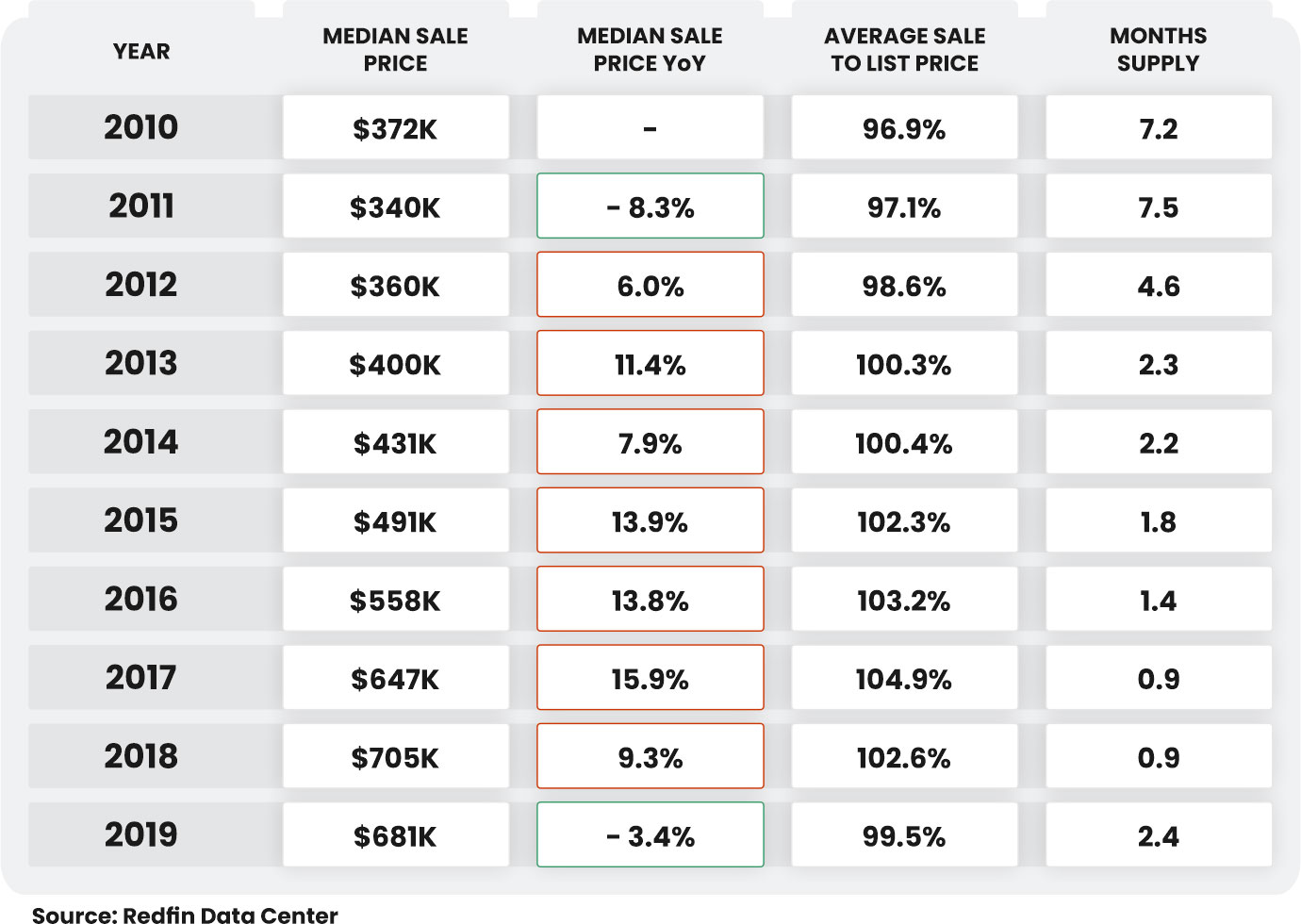

Seattle wasn’t immune to the 2007 housing collapse (home values declined by 33% between 2008 and 2012). But up until that point the Seattle housing market had been consistently positive. A Seattle Times Sunday cover from 2006 reported consistent year-over-year growth in home prices since 1985.

Of course, it was the most recent decade that brought the Seattle housing market to the national spotlight. This eventually earned the city the designation of “the nation’s hottest housing market” between 2016 and 2018.

Growing Home Values

After Seattle home values bottomed out at the beginning of 2012, they grew consistently up until 2019. At the same time, Seattle’s housing supply was dwindling. This created a seller’s market that had buyers paying far above asking price in order to secure a home. First-time homebuyers felt that they had been priced out of the city.

Affordability Issues

The Seattle housing market began to cool in 2019 due to affordability issues (what economists call a “market correction”). Home prices dropped by 3.4% and the supply of homes increased by 166.7%. For the first time in years, buyers could expect to spend slightly less than a home’s asking price.

> Learn more: Seattle Real Estate Trends

2022 Market Predictions for Seattle Real Estate

So what does buying a home in Seattle look like in 2022?

Entering 2022, homebuyers in King County are seeing an average home price of $759,735, which is up 11.88% from 2021. Additionally, the region has far less than the suggested inventory of four to six months supply of homes. This meant Seattle was far from a “balanced market”.

Although Seattle’s housing supply and demand have become a bit more balanced, it’s still a seller’s market. Sellers have the upper hand when it comes to negotiating offers.

> Learn more: Guide for Renters Curious About Owning in Seattle

High Demand and Low Inventory

In fact, experts expect the Seattle housing market to be more competitive for buyers this year compared to the past few years due to the high demand and low inventory. And demand is particularly high at the lower end of the pricing spectrum, increasing the competition even further for homes in that price range.

Record-Breaking Home Prices

This, paired with record-breaking housing prices, lack of home construction, a market driven by tech businesses and big corporations, and the increase of remote working all factor into Seattle’s competitive market.

Although real estate professionals predict house prices to continue to rise, experts expect that the slower rate of price increases and slowly increasing inventory could help alleviate pressure and improve housing availability when buying a home in Seattle.

High Rent Prices

Despite young residents’ overwhelming preference for renting, buying often makes more financial sense in Seattle.

Part of the reason for this is pretty straightforward: Home prices in Seattle may be high, but so is rent. If residents are going to be shelling out such a large amount to live here, they may as well be investing in homeownership.

> Learn more: 5 Priceless Reasons to Save Up to Buy a Home vs. Renting

High Appreciation Rates

That brings us to the second reason why buying a home in Seattle makes more sense than renting — the home equity. Seattle homes have appreciated at an annual rate of nearly 6.5%, putting the city in the top 10% for national real estate appreciation.

All of this appreciation is money in a homeowner’s pocket in the form of home equity, and it usually far outweighs the added cost of a monthly mortgage over rent.

Sellers tend to price more aggressively from November through April anyway, after which inventory usually increases. The best option for buyers who want to avoid low inventory is to start searching in early spring. However, with the increased inventory typically comes more competition from other prospective buyers.

> Learn more: Seattle’s Current Housing Market

Renting vs. Buying in Seattle

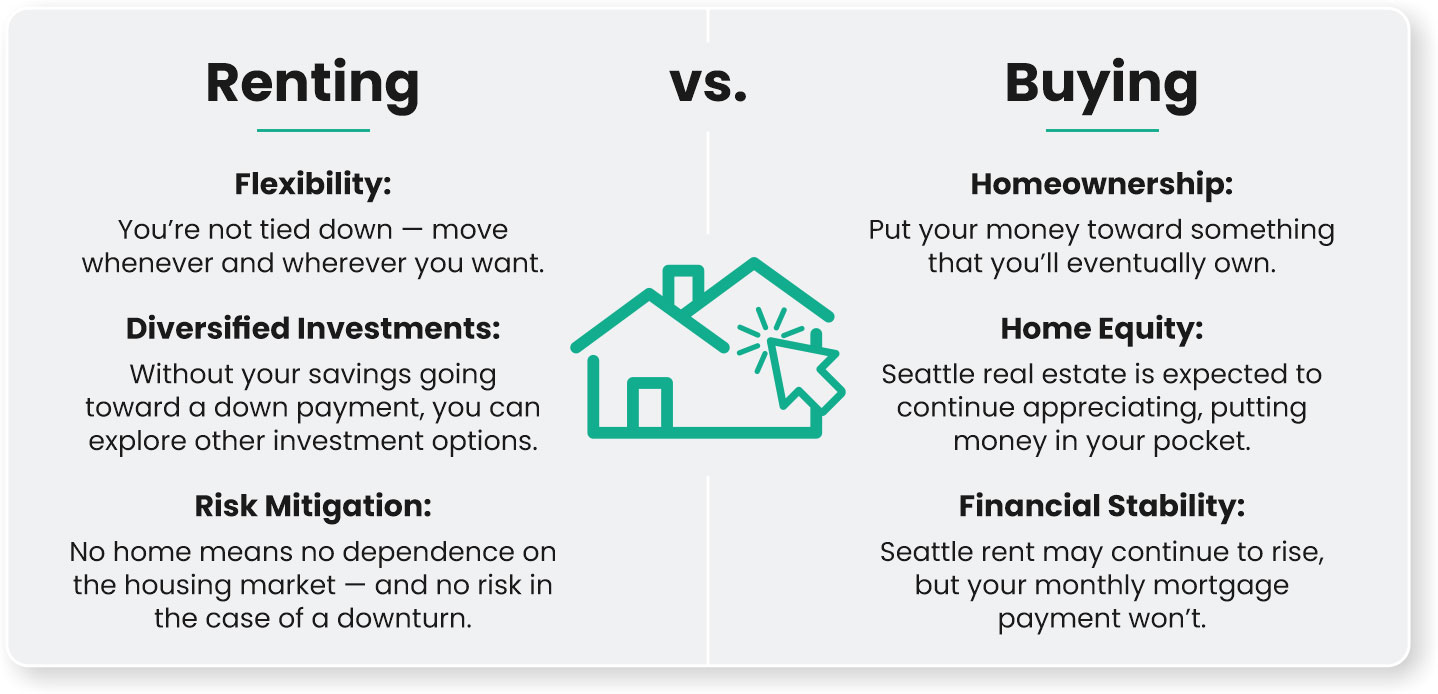

The high cost of buying a home in Seattle has many Seattleites renting instead of buying. This causes what the Seattle Times terms a “renter boom.” Seattle’s population was split evenly between renters and homeowners in 2019, and if the renter boom continues, renters will quickly become the majority. This hasn’t been the case since before 1950.

Despite young residents’ overwhelming preference for renting, buying often makes more financial sense in Seattle.

Part of the reason for this is pretty straightforward: Home prices in Seattle may be high, but so is rent. If residents are going to be shelling out such a large amount to live here, they may as well be investing in homeownership.

> Learn more: 5 Priceless Reasons to Save Up to Buy a Home vs. Renting

That brings us to the second reason why buying a home in Seattle makes more sense than renting — the home equity. Seattle homes have appreciated at an annual rate of 5.96%, putting the city in the top 10% for national real estate appreciation. Even considering Seattle’s recent decline in appreciation, experts predict home prices to continue rising.

All of this appreciation is money in a homeowner’s pocket in the form of home equity, and it usually far outweighs the added cost of a monthly mortgage over rent.

> Learn more: Guide for Renters Curious About Owning in Seattle

Down Payments in Seattle

What’s the Average Down Payment in Seattle?

The down payment is often the largest obstacle to buying a home in Seattle, as most residents aren’t eligible for down payment assistance. The median down payment in King County topped $100,000 for the first time in 2017, and most King County residents that finance their home purchase with a mortgage put 18% down.

However, a significant portion (23%) of King County residents aren’t relying on a mortgage at all, instead purchasing entirely with cash. In a competitive market like Seattle’s, these offers are naturally more competitive than offers that involve financing 80% or more of the purchase price.

Down Payment Assistance in Seattle

Down payment assistance programs in the Seattle area can be difficult to qualify for, as they typically have income restrictions as well as geographic restrictions. A far more common alternative is for buyers to put less than 20% down. This is very common among first-time homebuyers.

> Learn more: Why Waiting to Save a 20% Down Payment May Not Be the Right Move

FHA Loans

For those buying a home in Seattle who want to put as little down as possible, Federal Housing Administration (FHA) loans require as little as 3.5% down. FHA loans can be a great option if a buyer only has 3.5% to put down, but they come with certain drawbacks, such as higher monthly mortgage insurance as well as upfront mortgage insurance that lenders typically finance into the loan.

Additionally, at the time of this writing, lenders never eliminate the monthly mortgage insurance on an FHA loan regardless of how long you have the mortgage, requiring you to refinance to get rid of it.

Veterans (both active and retired) may be able to buy a home with NO money down if they meet certain eligibility requirements.

Gifts and 401k

Two options that many first-time homebuyers use to help with a down payment are gifts from family and borrowing from a 401(k) account. If you’re considering these options when buying a home in Seattle, be sure to ask your mortgage professional about their advantages and drawbacks

> Learn more: Mortgage Options With No (or Low) Down Payments

How to Get a Home Loan in Seattle

Before beginning a home search, potential buyers normally get “preapproval,” a process that involves a mortgage loan advisor reviewing their credit, income, and assets to ensure that they meet guidelines for mortgage financing up to a given price point.

Preapproval doesn’t require detailed verification of this information, though, and thus isn’t a commitment to lend.

>Learn more: In a Hurry? Tips to Close Your Mortgage Quickly

Get Full Credit Approval

Many Seattle homebuyers are going one step further to make themselves more attractive to sellers and seek full credit approval. A full credit approval involves checking and verifying all of the buyer’s financial information.

While people traditionally perform these underwriting reviews after the home is already under contract, completing them earlier helps strengthen the buyer’s offer. From the seller’s perspective, a potential buyer with verified assets, income, and credit is a “more solid” buyer than one that has not had their financials reviewed in detail by a lender.

> Learn more: The Difference Between Preapproval and Full Credit Approval

Go With a Local Broker

Along the same lines, Seattle homebuyers are also learning the importance of going with a local mortgage broker or company instead of a bank — if not for the extra guidance that brokers provide, then at least to avoid the bureaucratic processes that often slow deals down. Sellers want assurance that a deal will close efficiently and without surprises.

Many local lenders, on the other hand, have developed relationships with local realtors that they can use to buyers’ advantage in a bidding war. For example, Seattle Mortgage Planners makes it a rule to reach out to both real estate agents directly to help facilitate financing.

> Learn more: The Purchase Loan Process

How to Find the Best Seattle Realtor

Considering how important realtors are to the homebuying process, surprisingly few resources are available to help buyers choose the right one. Many buyers rely on paid advertisements or referrals, neither of which is a reliable indication of knowledge and experience.

Focus on the Individual

The fact that a realtor works for a large, well-known company is also less telling than most homebuyers assume. All companies are going to have savvy realtors and less savvy realtors, so buyers should focus more on the individual and less on the company they work for.

That being said, while it’s important to get along with your real estate agent, it shouldn’t be the deciding factor. Everyone can be nice, but that doesn’t mean they’ll be able to find you the right house and get it into contract at the right price.

Ask About Experience

A good rule of thumb is to ask about their experience — and in this case, experience doesn’t mean how long they’ve been a real estate agent, but how many sales they close annually. If that number is six or less, you may want to find someone who sells homes with more regularity.

Agents who are closing one or more homes per month are typically going to know more and be more familiar with local listing agents, potentially getting you information on questions such as price flexibility.

While many homebuyers feel awkward asking for an agent’s annual transaction quantity, it’s an important metric and you shouldn’t overlook it for the sake of politeness. In fact, the best realtors will expect this question and be happy to answer it.

Find a Realtor in Your Area

Also keep in mind that most realtors are focused on one area, meaning that they may know a lot about one neighborhood but very little about others. If you know you want to live in a certain area, you may want to seek out a real estate agent who’s an expert in that particular area.

Avoid Budget Agents

Lastly, beware of agents who give buyers back a percentage of their commission. These budget agents are giving homebuyers money back for a reason — they may work on way more deals at a time, are doing less to represent their clients, and can be more transactional than full-service real estate agents. They might give you 1% back, but if you overpay by $100K due to an oversight, who cares about 1%?

>Learn more: How To Find the Best Seattle Realtor

Best Seattle Neighborhoods for Homebuyers

Seattle neighborhoods are distinctive, both in terms of home prices and the general vibe. So before Seattle homebuyers start shopping for the right house, they should consider the specific area they want to live in.

The best Seattle neighborhood to buy a home in depends largely on what you can afford, how much space you need, and the kind of area you want to live in. Learn more about each area on its specific neighborhood page.

How to Find the Right House in Seattle

Be Ready to Move Fast

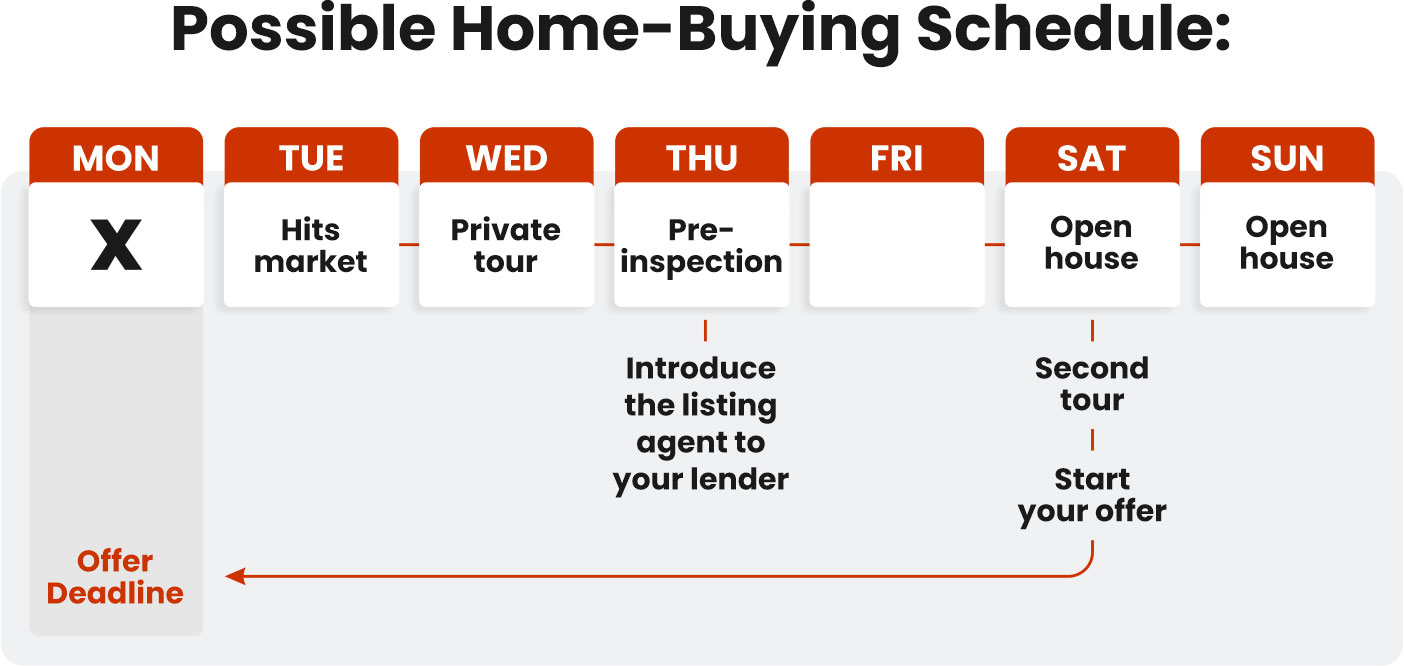

In a seller’s market like Seattle’s, the homebuying process moves extremely quickly. Seattle homes for sale in 2022 spend an average of only 6 days on the market, compared to 7 days in 2021.

Preparing can make the difference between getting and not getting the house. Within just about one week, you’ll have to schedule a private tour, attend the open house, hire someone to complete a pre-inspection, introduce your lender and agent to the listing agent, and put together your offer — not to mention make one of the biggest financial decisions of your life.

> Learn More: The Best Times to Buy a House in Seattle

Be Wary of the Asking Price

The asking price and the final sale price for a home don’t always match up, especially in a seller’s market. Some sellers honestly indicate the minimum amount they’re willing to accept, but just as many underprice their homes to create a bidding war and drive the price up. Smart homebuyers will rely on their real estate agent’s insight and online reviews to avoid wasting their time on homes that will end up being way out of their price range.

Before the cooling of the Seattle housing market, houses were going for about 6 to 7% above their asking price. That continues to be the case, with over 60% of homes selling for above asking price. Homes are even selling for 40% over asking in some cases.

Look Under Your Budget

Nevertheless, real estate agents recommend looking for houses that are one level below their budget limit, meaning that buyers who are willing to spend $700,000, for example, should look at homes priced around $650,000. This ensures that buyers won’t go past their financial limits.

And even more importantly, don’t fall in love with a home before you sign the contract — it will only make it that much harder if your offer falls through. As a managing broker at Re/Max points out, “It is not unusual for buyers to make 10 or 12 offers on homes before they finally get one.”

Go Off the Market

You’ve probably noticed those “We Buy Homes” signs in neighborhoods around Seattle and wondered what they were all about. The people who put up these signs are trying to purchase homes before they hit the market, which is probably the best way to get a good deal on a house.

Granted, we don’t recommend this tactic for Seattle residents looking to purchase a home for themselves (even commercially, it doesn’t have a great success rate), but purchasing homes off the market is a good idea if possible.

Most homebuyers who go off market purchase from friends and family, but you can also look for “For Sale by Owners” signs. Sometimes owners who are selling can have unrealistic price expectations for their home, however.

> Learn more: How to Buy Off-Market Homes

Look for Houses That Aren’t Selling

We’ve already established that most Seattle homes sell quickly, but the ones that don’t could be an opportunity to get a good deal.

Just as recently listed homes tend to spur homebuyers to act fast, homes that have been on the market for more than a couple of weeks give the (oftentimes baseless) impression that something’s wrong with them. These homes could remain unsold for any number of reasons, such as a too-high listing price or a sale that fell through in closing.

Work with your real estate agent to take a closer look at these listings — if you get lucky, you might get to be the only bidder and come in below the asking price.

> Learn More: Seven Reasons Why Homes in Hot Markets Don’t Sell Right Away

Consider Homes That Need Some Work

Sometimes homebuyers can get a steal by purchasing a fixer-upper and committing to putting in a lot of work, but now even homes beyond repair can spark a bidding war if the location is good.

However, you can still save yourself some cash by overlooking cosmetic issues that might be deal breakers to less open-minded buyers. When weighing the importance of a specific issue, consider what it would actually cost to fix it — either yourself or by hiring someone — and how inconvenient it might be.

> Learn More: The Best Financing Options for House Flipping

Look for Duplicates

The Seattle housing market isn’t brimming with options right now (inventory continues to be at an all-time low), but you might get lucky and find multiple houses for sale in your ideal neighborhood.

When this happens, most buyers gravitate toward the nicer home. While a less nice home might win if it’s the only home for sale, now it presents a great opportunity for less competitive bidding.

How to Win a Bidding War in Seattle

Once you’ve found “the” home, it’s time to make an offer; and chances are, you won’t be the only one doing so. Bidding wars are less likely in Seattle now that the Seattle housing market has cooled somewhat, but they are always a concern in a seller’s market, especially with the most attractive listings.

Buyers have several options to make their offers more attractive, but real estate professionals don’t necessarily recommend doing all of these things. Your realtor can add a lot of value here — work with them to determine the best way to make your offer stand out without making a risky move.

>Learn more: Tips for Deciding How Much to Offer on a House

Waive Contingencies

A real estate contingency is a condition in the purchase agreement that the buyer and seller must agree on for the transaction to move forward. Contingencies should protect the buyer, but some buyers choose to waive them to make their offers more competitive.

Here are a few of the most common contingencies buyers choose to waive:

Inspection Contingency

Buyers traditionally opt for a home inspection after getting the home into contract. An inspection contingency gives the buyer the right to renegotiate the sale price or completely back out of the deal if the inspection reveals costly issues.

By completing an inspection prior to making an offer, buyers can waive the inspection contingency, effectively telling the seller that they find the condition of the home acceptable and will not back out or renegotiate due to the inspection results.

Appraisal Contingency

Mortgages aren’t based on a home’s sale price — they’re based on a neutral third party’s appraisal, which can be an issue when bidders force a home’s price over its market value.

Sellers’ concern is that buyers will back out of the deal if their appraisal comes in lower than the agreed upon sales price, so by waiving the appraisal contingency, buyers agree to purchase the home no matter what the appraisal value is.

Buyers who choose to do this must make sure they don’t put all of their savings toward the down payment, as they may need some extra cash to cover the difference between the agreed upon sales price and the appraised value. Your real estate agent should carefully examine comparables to make sure the sales price is accurate before waiving the appraisal contingency.

Title Contingency

According to Washington law, sellers must provide a title detailing the property specifics. If the title unearths any unwelcome surprises, the buyer can renegotiate the price or even back out of the deal — unless they waive the title contingency.

Buyers that choose to do this should first investigate public records databases to learn everything about the title that they can. People waive this contingency less often than some of the other alternatives.

Financing Contingency

A financing contingency allows the buyer to back out of a deal if their home loan falls through. Waiving it assures the seller that you’ll buy the home no matter what — even without financing. This can be a very effective contingency to waive in a competitive buying scenario.

In a competitive market, it’s smart to get a full credit approval prior to making offers. If you need to waive your financing contingency for a seller to consider your offer, you can do so with little risk since you already have a credit approval in hand. Discuss waiving this contingency with your mortgage professional to determine the potential risk.

> Learn More: Guide to Real Estate Contingencies

Agree to Rentbacks

Sellers don’t always have a new living arrangement lined up by the time their current home sells. To ease the seller’s transition (and make their offer more impressive), buyers can offer a rent-back agreement — essentially, an agreement to allow the seller to stay in the home for a few extra months after closing by “renting it back” to them.

In addition to giving your offer an added edge, offering rentbacks can also help recoup some of your closing costs through the rent you’ll receive.

It’s important to note that rentbacks can have limitations put in place by the buyer’s financing, so be sure to check with your mortgage professional to see what the rentback limitations will be.

> Learn More: Considering a Rent-Back Agreement? Here’s What You Need to Know

Offer Non Refundable Earnest Money

After both parties agree on the deal, buyers can offer the seller an earnest money deposit. This deposit, which is usually between 1% and 3% of the home’s purchase price, proves that the buyer intends to follow through with the purchase agreement. However, the buyer can accept an earnest money refund given certain contingencies in the contract.

Competitive Seattle buyers may offer as much as 5 to 10% in earnest money. This can amount to $44,000 to $88,000 for the average Seattle home (based on a median sale price of $880K in March 2022).

While this deposit would typically be refundable up to a certain point in the process, by making the earnest money nonrefundable, buyers are agreeing to release any claim to the deposit, regardless of contingencies (meaning that they will lose that money if the deal falls through).

Only the strongest buyers should consider making earnest money nonrefundable due to the risk involved.

> Learn more: What to Know About Earnest Money Deposits in Seattle

Write a Letter to the Seller

Writing a letter to the home’s seller is becoming the norm. These letters offers the buyer a chance to make themselves stand out from other bidders. Letters can include pictures of their family, personal background information, and plans for the future. Because it’s so commonplace, however, it can be difficult to really separate yourself from other buyers.

Whether or not letter writing is effective is debatable. Some sellers really do care about whom their house is going to. But others may not even end up reading them. Listing agents sometimes throw them away so that they don’t cloud the seller’s focus. Of course, writing a letter never hurts.

> Learn More: Homebuyers: Seal the Deal With a Winning Letter to the Seller

Ask to Be Second in Line

The winning offer doesn’t always work out. When this happens, sellers have to start the bidding process all over again. To save sellers this trouble, buyers can ask to be second in line if their initial offer is not successful.

Include an Escalation Clause

The surest way to get sellers to accept your offer is to offer the most money. Of course, even if you have the cash, this is easier said than done. Buyers run the risk of bidding too low, or bidding too high and spending more than was really necessary.

An escalation clause (sometimes called an escalator) solves this dilemma. Escalation clauses allows buyers to automatically increase their bid by a certain amount if the seller receives a higher offer. If multiple bidders use escalation clauses, the listing agent will have to call them to see their limit.

> Learn more: Best Practices for Using Escalation Clauses in Real Estate

Be Thorough

Buyers could follow all of the above tips and still not have their offer accepted. The most common reason is because they aren’t thorough enough. A great offer may look more suspicious than attractive. Especially if the offer form is incomplete or the numbers don’t add up.

This is the responsibility of your agent, and is another reason for you to choose a knowledgeable real estate agent.

At the end of the day, the seller wants to have confidence that the deal will close. It’s the buyer’s responsibility to give them that confidence. This comes down to checking off all the boxes. Buyers should get full credit approval, work with an experienced mortgage broker, and so on.

Closing Costs and Prepaids in Seattle

One-time costs associated with the closing of a mortgage are closing costs. Examples of these costs include the appraisal, title insurance, escrow, recording, underwriting, and credit report.

What Are Prepaids?

Prepaids are technically different than one-time closing costs. Prepaids consist of property taxes, homeowner’s insurance, and prepaid interest. Most lenders structure mortgages in the Seattle area with an “escrow” account.

A portion of your monthly payment goes into the escrow account. Twice a year the lender pays your property taxes using funds from the escrow account. When your insurance policy is due for renewal, the lender pays for using funds from the escrow account.

Funds in the escrow account belong to the homeowner. If the home sells or the loan refinances, all of the funds in the escrow account refund back to the homeowner. This happens typically 30 days after the buyer pays off the loan (which occurs when the home sells or when they refinance the mortgage mortgage).

Reducing Closing Costs

Closing costs and prepaids add to the amount needed for closing a mortgage. For example, if someone were to buy a $600,000 property and put 20% down, they would need to prepare to bring in the $120,000 down payment. They would also need to provide closing costs and prepaids.

The closing costs and prepaids can vary considerably since they include property taxes, and taxes can vary. A rule of thumb in the Seattle market is to prepare for $10,000 in closing costs and prepaids. But expect that figure to vary significantly from home to home.

Buyers can only do so much to reduce their closing costs. The most common option is to choose a slightly higher interest rate and have the lender pay for some costs. This sometimes makes sense and sometimes does not, so be sure to have the conversation with your mortgage professional.

> Learn more: Guide to Closing Costs in Washington State

Next Steps

Buying a home in Seattle isn’t easy, especially because there’s no one “right” path toward homeownership. Every buyer situation is different, and the right move for one homebuyer could be a costly mistake for another. In the end, the best approach to ensure you’re making smart decisions is to work with experienced professionals.

Contact Seattle Mortgage Planners Today!

At Seattle Mortgage Planners, our goal is to make the homebuying process as simple and positive as possible. All you need is a quick phone consultation with Jim to start your journey.

Schedule a phone call with Jim to take the first step toward being a homeowner. In the meantime, check out our neighborhood pages to explore the area you could soon be calling home.